Safeco Insurance Claims Phone Number: Your Ultimate Guide To Easy Claims Processing

When life throws unexpected challenges your way, having the right insurance can be a game-changer. Safeco Insurance is one of those trusted names that people turn to when they need peace of mind. But let’s be real—nobody wants to deal with the hassle of filing claims, right? That’s why knowing the Safeco Insurance claims phone number can save you a ton of time and stress. Whether it’s a car accident, property damage, or any other covered event, having the right contact info at your fingertips makes all the difference.

Imagine this: You’ve just been in an accident, and you’re scrambling to figure out what to do next. The last thing you want is to waste hours trying to find the right number to call. That’s where we come in. This article will walk you through everything you need to know about Safeco Insurance claims, including their claims phone number, the claims process, and some pro tips to make your experience smoother. Think of it as your cheat sheet for navigating the world of insurance claims.

But wait, there’s more! We’ll also dive into some lesser-known facts about Safeco Insurance, share expert advice on maximizing your coverage, and give you the inside scoop on how to avoid common pitfalls. So grab a coffee, settle in, and let’s demystify the Safeco claims process together.

- Unveiling Katniss Everdeen The Symbol Of Resistance And Resilience

- Val Kilmer 2024 A Look Into The Iconic Actors Journey And Future Projects

Understanding Safeco Insurance and Its Claims Process

What Is Safeco Insurance All About?

Safeco Insurance has been around since 1938, and over the decades, it’s built a solid reputation for providing reliable coverage to millions of customers across the United States. As part of the Liberty Mutual Group, Safeco offers a wide range of insurance products, including auto, home, renters, and business insurance. Their mission? To protect what matters most to you while delivering exceptional service.

But let’s face it—insurance isn’t all sunshine and rainbows. When you need to file a claim, things can get tricky. That’s why understanding how Safeco handles claims is crucial. Whether you’re dealing with a fender bender or a burst pipe, knowing the process will help you stay calm and collected. Oh, and did we mention the Safeco Insurance claims phone number? It’s going to be your best friend during this journey.

Why Knowing the Safeco Claims Phone Number Matters

Let’s cut to the chase: The Safeco Insurance claims phone number is your gateway to getting your claim resolved quickly. While online portals and mobile apps are great for handling routine tasks, sometimes nothing beats a good old-fashioned phone call. When you call the claims department, you’ll be connected to a live representative who can guide you through the process step by step.

Here’s the deal: The main Safeco claims phone number is 1-800-SAFECO1. But hold up—don’t just dial it blindly! Depending on your policy type and location, you might need to use a different number. For example, if you’re filing an auto claim, you’ll want to use the dedicated auto claims line. We’ll break it down further in the next section, so stick around.

Step-by-Step Guide to Filing a Claim with Safeco

Before You Call: Gather Your Info

Before you dial that Safeco Insurance claims phone number, it’s essential to gather all the necessary information. Trust us—this will save you a ton of time and frustration. Here’s a quick checklist of what you’ll need:

- Your policy number (you can find this on your insurance card)

- Details of the incident (date, time, location)

- Contact information for any involved parties (e.g., other drivers, witnesses)

- Photos or videos of the damage (if applicable)

- Police report number (if one was filed)

Having all this info ready will help the claims representative process your case faster. Plus, it shows that you’re organized and serious about your claim. Win-win!

Calling the Safeco Claims Phone Number

Once you’ve got your ducks in a row, it’s time to make that call. When you reach out to the Safeco Insurance claims phone number, you’ll likely be greeted by an automated system. Don’t panic—just follow the prompts to connect with a live agent. If you’re filing an auto claim, you might need to use the dedicated auto claims line, which is 1-800-241-1711.

During the call, the representative will ask you a series of questions to gather details about your claim. Be honest and thorough in your responses. Remember, the more accurate the information you provide, the smoother the process will be. And hey, if you’re feeling unsure about anything, don’t hesitate to ask questions. That’s what they’re there for!

Common Questions About Safeco Claims

How Long Does It Take to Process a Claim?

This is one of the most frequently asked questions, and for good reason. Nobody likes waiting around for their claim to be resolved. According to Safeco, most claims are processed within 30 days. However, the exact timeline can vary depending on the complexity of your case. For example, if your claim involves significant property damage, it might take longer to assess and settle.

Pro tip: If you haven’t heard back after a few weeks, don’t hesitate to follow up. You can either call the Safeco Insurance claims phone number or check the status of your claim online through your account dashboard. Staying proactive is key to ensuring your claim stays on track.

What Happens After I File My Claim?

After you file your claim, Safeco will assign an adjuster to your case. This person’s job is to investigate the details of your claim and determine the appropriate settlement. They may ask for additional documentation or schedule an in-person inspection, especially for larger claims.

Once the investigation is complete, Safeco will send you a settlement offer. If you agree with the terms, you’ll receive your payment either via check or direct deposit, depending on your preference. Simple, right?

Maximizing Your Safeco Coverage

Know Your Policy Limits

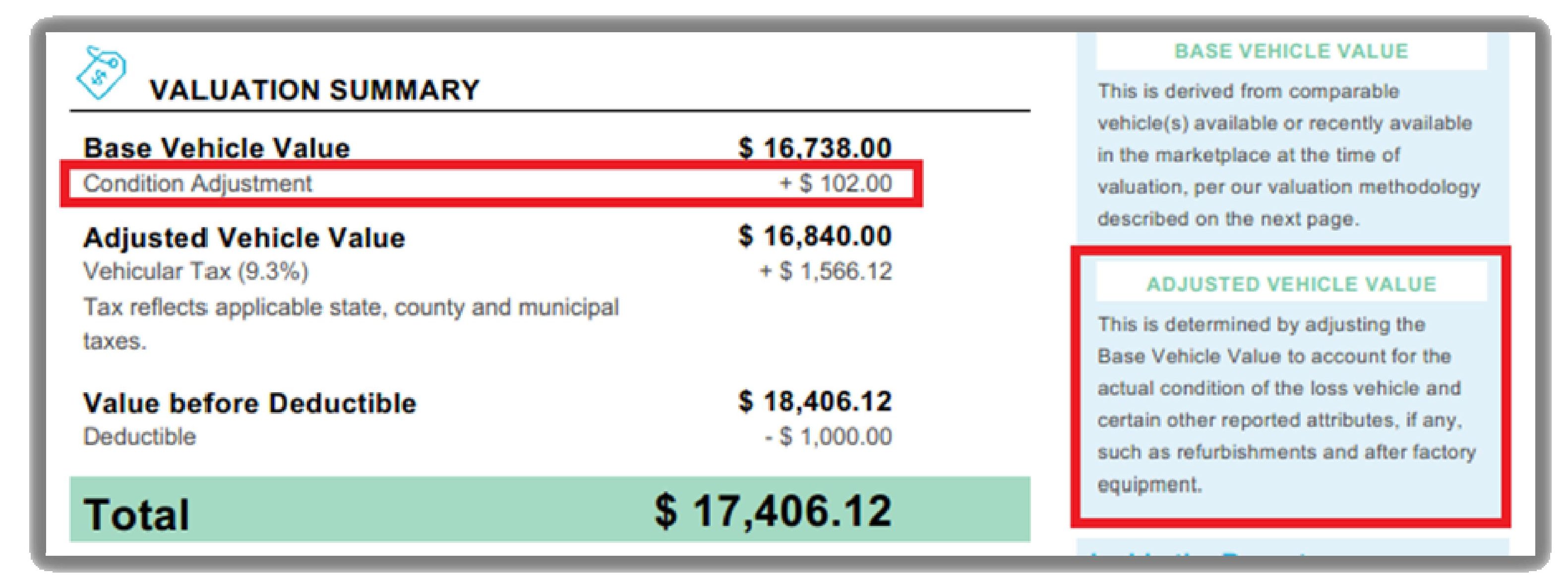

One of the biggest mistakes people make when filing claims is not understanding their policy limits. For example, if you have a $500 deductible on your auto policy, that means you’ll need to pay the first $500 out of pocket before Safeco covers the rest. Make sure you review your policy documents carefully so you know exactly what’s covered and what’s not.

Another thing to keep in mind is that different types of coverage have different limits. For instance, collision coverage and comprehensive coverage work differently. Knowing the nuances of your policy will help you avoid unpleasant surprises down the road.

Consider Adding Extra Coverage

If you’re looking for extra peace of mind, consider adding endorsements or riders to your policy. For example, gap insurance can be a lifesaver if you’re leasing or financing a car. Similarly, roadside assistance coverage can come in handy if you frequently travel long distances. These options might cost a bit more upfront, but they can save you a ton of money in the long run.

Tips for a Stress-Free Claims Experience

Stay Organized

As we mentioned earlier, staying organized is key to a smooth claims process. Create a folder (physical or digital) where you can store all your claim-related documents. This includes emails, receipts, photos, and any other relevant info. Trust us—future you will thank you for this!

Communicate Clearly

When dealing with Safeco’s claims department, clear communication is crucial. Avoid using jargon or overly technical terms unless you’re sure the representative understands them. If something isn’t clear, ask for clarification. And don’t forget to take notes during your conversations—this will help you keep track of important details.

Real-Life Examples of Safeco Claims

Case Study: Auto Claim After a Minor Accident

Meet Sarah, a Safeco policyholder who recently got into a minor fender bender. She called the Safeco Insurance claims phone number immediately after the incident and followed the representative’s instructions to a T. Within a week, her claim was processed, and she received a fair settlement to cover the repairs. Moral of the story? Acting quickly and providing accurate information can make all the difference.

Case Study: Homeowners Claim After a Storm

John, a long-time Safeco customer, experienced significant roof damage after a severe storm. He filed a claim using the dedicated homeowners claims line and worked closely with his adjuster to assess the damage. Despite the complexity of the case, Safeco managed to settle the claim within a month, allowing John to get his home back in shape.

Conclusion: Take Control of Your Claims Process

So there you have it—everything you need to know about Safeco Insurance claims and the importance of knowing the right phone number. Whether you’re filing an auto claim, homeowners claim, or any other type of claim, being prepared and informed is the key to success. Remember, the Safeco Insurance claims phone number is your lifeline during this process, so don’t hesitate to use it when needed.

Before you go, here’s a quick recap of the key takeaways:

- Always gather all necessary info before calling the claims department.

- Use the dedicated claims phone number for your specific policy type.

- Stay organized and communicate clearly with your claims representative.

- Know your policy limits and consider adding extra coverage if needed.

Now it’s your turn! Have you ever filed a claim with Safeco? What was your experience like? We’d love to hear your thoughts in the comments below. And if you found this article helpful, don’t forget to share it with your friends and family. Together, let’s make navigating the world of insurance claims a little less stressful!

Table of Contents

- Understanding Safeco Insurance and Its Claims Process

- Why Knowing the Safeco Claims Phone Number Matters

- Step-by-Step Guide to Filing a Claim with Safeco

- Before You Call: Gather Your Info

- Calling the Safeco Claims Phone Number

- Common Questions About Safeco Claims

- How Long Does It Take to Process a Claim?

- What Happens After I File My Claim?

- Maximizing Your Safeco Coverage

- Know Your Policy Limits

- Consider Adding Extra Coverage

- Hugh Grosvenor And Olivia Henson The Engagement Ring That Sparked A Royal Romance

- How Did Bob Seger Pass Away

Claims Center Safeco Insurance

Safeco Home Insurance Claims Number Homemade Ftempo

Safeco Home Insurance Claims Number Homemade Ftempo